Legacy impact strategist | Chicago

Build a Legacy

Live a Legacy

Leave a Legacy

Helping Families Turn Today’s Decisions Into Generational Wealth

Clarity before commitment.

Legacy impact strategist | Chicago, Il

Get personalized Legacy Strategiesto help you achieve your goals in the shortest time.

The difference between having a trusted partner by your side committed to transforming your financial dreams into reality. Your future starts now, and we're here to lead you toward a prosperous tomorrow.

Legacy impact strategist | Chicago, Il

Get personalized Legacy Strategiesto help you achieve your goals in the shortest time.

The difference between having a trusted partner by your side committed to transforming your financial dreams into reality. Your future starts now, and we're here to lead you toward a prosperous tomorrow.

Daurice Jordan aka Mister Jordan

I help individuals and families build a legacy, live a legacy, and leave a legacy through intentional real estate ownership and strategic financial protection.

As a Legacy Impact Strategist, I combine licensed expertise in real estate and financial protection strategies to help my clients make smarter decisions today that positively impact generations tomorrow.

Legacy is not an accident.

Legacy is a strategy.

Legacy is your birthright.

Legacy is Your Birthright

/

leg·a·cy

/ˈleɡəsē/

1. your divine interation with the world

Services

Your home isn't just a place to live—it's a wealth-building system. While most people focus on price and rates, true wealth comes from time in the market, not timing it. Every mortgage payment is a forced investment in your future. Equity compounds. Stability compounds. Identity compounds. This isn't about buying a house—it's about activating a system designed to build financial security and legacy for decades to come.

The Compound Home EffectTM

95% of Americans struggle financially not because they don't earn enough, but because they're building on the wrong structure. The wealthy don't earn more—they structure differently. They protect what they build. They ensure wealth compounds uninterrupted. This presentation reveals the gap between those who build lasting wealth and those who don't. It's not about access to secrets—it's about education, decision, and action.

Fighting Financial Ignorance

Most parents save for college. Legacy builders plan for life. This strategy goes beyond 529s and custodial accounts—it builds a financial foundation that supports your child through every stage: college at 18, a home at 30, a business at 40, retirement at 65. One decision. Lifelong impact. The earlier you start, the more powerful it becomes. This is the ultimate Build strategy for the next generation.

Million Dollar Baby

The Compound Home Effect

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Fighting Financial Ignorance

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Million Dollar Baby

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Services

From hassle-free booking and flexible rental periods to complimentary roadside assistance, we're here to ensure your journey is smooth and enjoyable.

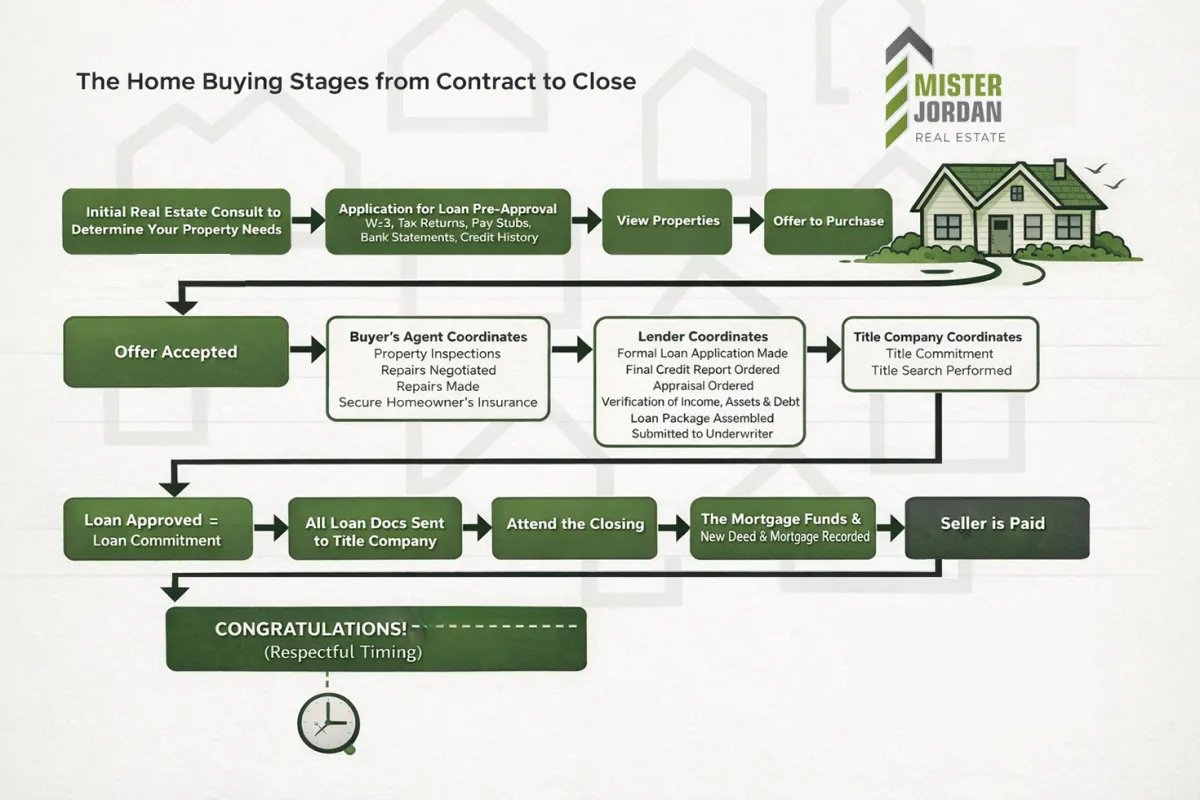

Home Buyers

Buying a home in Chicago doesn’t have to feel overwhelming. Whether you’re dreaming up your first condo or searching for your forever place, I’ll help you cut through the noise, find homes that truly fit your goals, and guide you confidently from search to keys-in-hand. Ready to see how it all works?

Home Sellers

Mitigate risks and protect your assets with our insurance guidance. We analyze your unique needs and recommend the right coverage to shield you from unexpected events.Peace of mind through comprehensive insurance solutions, safeguarding what matters most.

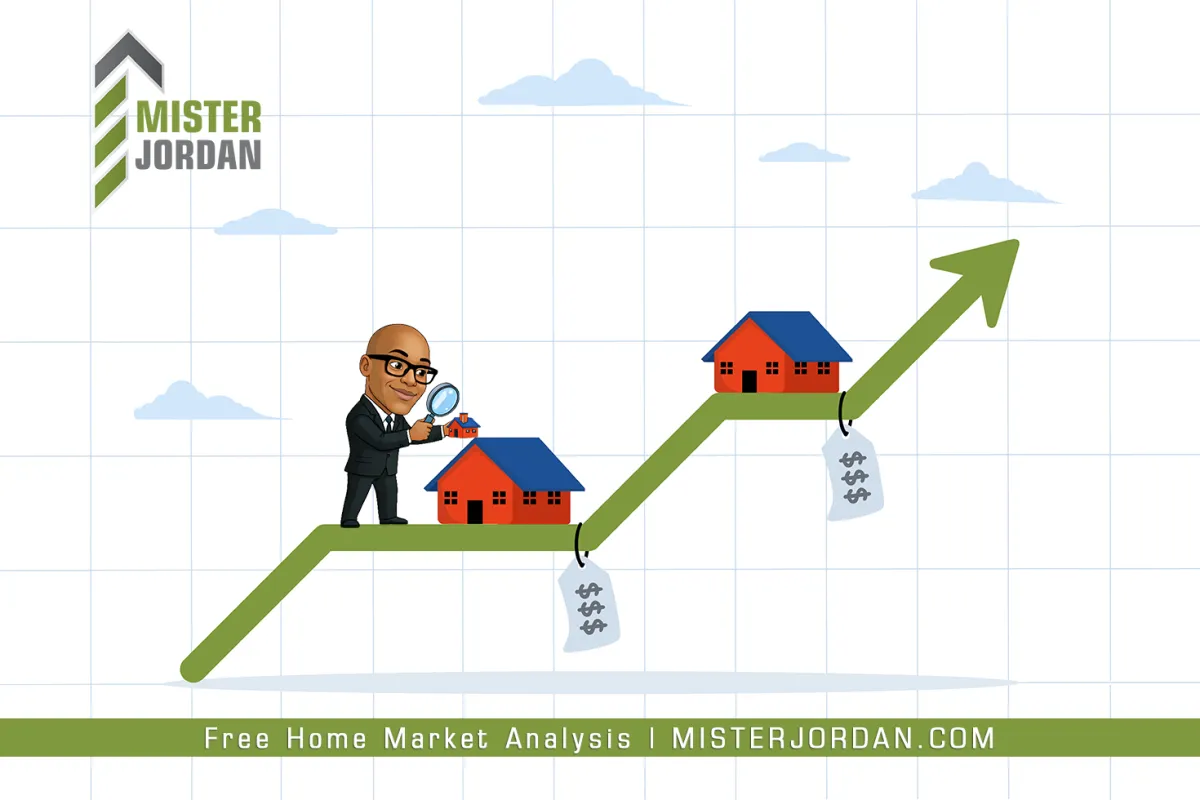

Free Home Market Analysis

Our expert advisors meticulously craft personalized financial plans that encompass your short and long-term goals. From budgeting and debt management to retirement and estate planning, we ensure a roadmap for your financial success. Tailored blueprints for your financial journey, ensuring each step aligns with your aspirations.

Life Insurance

Prepare for your children's education expenses with effective funding strategies. We help you explore savings plans and investment options tailored to your educational goals. Empowering your children's futures by planning for their educational needs.

Annuities

Our expert advisors meticulously craft personalized financial plans that encompass your short and long-term goals. From budgeting and debt management to retirement and estate planning, we ensure a roadmap for your financial success. Tailored blueprints for your financial journey, ensuring each step aligns with your aspirations.

Free Policy Review

Prepare for your children's education expenses with effective funding strategies. We help you explore savings plans and investment options tailored to your educational goals. Empowering your children's futures by planning for their educational needs.

Strategies

Testimonials

★ ★ ★ ★

Exceptional guidance! Their financial planning helped me take control of my finances and work towards my retirement goals. The personalized approach made all the difference.

John Doe

★ ★ ★ ★

Trustworthy investment management! They kept my investments aligned with market trends, and their proactive adjustments have consistently delivered growth. Highly recommend!

Jane Doe

★ ★ ★ ★

Top-notch tax consultation! They navigated the complexities seamlessly, saving me money while ensuring compliance. A reliable partner for financial success.

John Doe

★ ★ ★ ★

Estate planning made easy! They helped me create a comprehensive plan, ensuring my family's future security. Their professionalism and expertise were truly reassuring.

Jane Doe

Financial Team

At [Financial Advisor Firm Name], our team is the driving force behind our commitment to your financial success. Comprised of seasoned professionals with diverse expertise, our team members share a common passion for empowering individuals and businesses to navigate the complexities of finance.

Book a Call

Life is Like This... and... I Like This

MISSION

LEGAL

Subscribe to our Mailing List

And that's just a peek at what we offer. Get more marketing tips straight to your inbox.

Copyright 2026. Mister Jordan. All Rights Reserved.